personal property tax rate richmond va

Interest will accrue each month starting November 1 2021 on unpaid balances. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

11 Things To Know Before Moving To Richmond Va

The assessment on these vehicles is determined by the Commissioner of the Revenue.

. The tangible personal property tax is a tax based on the value of the property commonly referred to as an ad valorem tax. Personal Property Taxes are billed once a year with a December 5 th due date. Personal Property Car Tax Relief.

For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. Taxation Subtitle III. For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax relief as set forth herein.

A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. Make an appointment Monday - Friday or stop by at your convenience any day were open. By Richmond City Council.

Virginia is ranked number twenty one out of the fifty states in order of the average amount of property. In case you missed it the link opens in a new tab of your browser. Henrico County now offers paperless personal property and real estate tax bills.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established. Personal Property taxes due to the Treasurers Office. Payments made using the coupons must be postmarked on the due date of the payment to be considered on time.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. 9 rows Personal Property. Personal Property Registration Form.

The City Assessor determines the FMV of over 70000 real property parcels each year. The online payment option provides you the ability to make the payment 247 and at your convenience. Any unpaid balance now includes a 10 penalty.

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Personal Property Tax Rate. Pay Personal Property Taxes.

074 of home value. Personal property taxes are due May 5 and October 5. Offered by City of Richmond Virginia.

The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. Pay Online or view Other Payment Options.

Personal Property Machinery and Tools Merchants Capital Table 1 Rates of County Levies for County Purposes for Tax Year 2018 Fiscal 2019 COUNTY Tax Rates Per 100 of Assessed Value On. The vehicle must be owned or leased by an individual and not used for business purposes to qualify for personal property tax relief. Giles 0630 1980 0830 Gloucester 0695 2950 2950 - Goochland 0530 4000 1000 - Grayson 0490 1750 6700 Greene 0775 5000 2500 -.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Tax amount varies by county. The current tax rate is 350 per hundred dollars of assessed value.

General classification of tangible personal property. Use the map below to find your city or countys website to look up rates due dates. Table of Contents Title 581.

Local Taxes Chapter 35. Tangible personal property tax relief. WRIC -- Governor Glenn Younkin signed House Bill 1239 into law today which empowers localities to cut tax rates on cars and to prevent tax hikes from the rise in used vehicle values.

Need assistance with making your online. Boats trailers and airplanes are not prorated. Tangible Personal Property Machinery and Tools and Merchants Capital Article 1.

Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Please include 10 with your payment.

134 rows Richmond is the capital of Virginia and the place where Virginias property tax laws. Richmond VA Department of Finance Tangible Personal Property Taxes. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

If you have questions about personal property tax or real estate tax contact your local tax office. The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 7501 pounds. Tangible personal property is the property of individuals and businesses in the city of Richmond.

The tax rate is 1 percent charged to the consumer at the time of rental payment. Tangible Personal Property Tax 581-3503. Tax rates differ depending on where you live.

Of the due date will be considered as on time. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less.

The 2021 Personal Property Taxes were due October 5 2021. Yearly median tax in Richmond City. Local tax rates on vehicles qualifying for tangible personal property tax relief.

Payments remitted online by 1159 pm. Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief. 1000 x 120 tax rate 1200 real estate tax.

The Board of Supervisors sets new tax rates approximately April of each year. 10 Facts Richmond Virginia American Battlefield Trust Richmond Free Press April 15 17 2021 Edition By Richmond Free Press Issuu 1801 Oak Hill Ln Richmond Va 23223 Realtor Com. Personal Property Tax Rate.

Box 27412 Richmond VA 23269. Pay Personal Property Taxes in the City of Richmond Virginia using this service.

11 Things To Know Before Moving To Richmond Va

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

9 Bedrooms 8 Full 3 Half Bathrooms 12 500 Sq Ft Price 34 000 000 Valo393148 Real Estate Equestrian Estate Estate Agent

The Best And Worst Cities To Own Investment Property Investing Investment Property City

How Decades Of Racist Housing Policy Left Neighborhoods Sweltering The New York Times

Public Housing In Richmond Virginia Richmond Cycling Corps

42969 Richmond Sterling Heights Mi 48313 Luxury Real Estate Sterling Heights Luxury Homes

Taxes Greater Richmond Partnership Virginia Usa

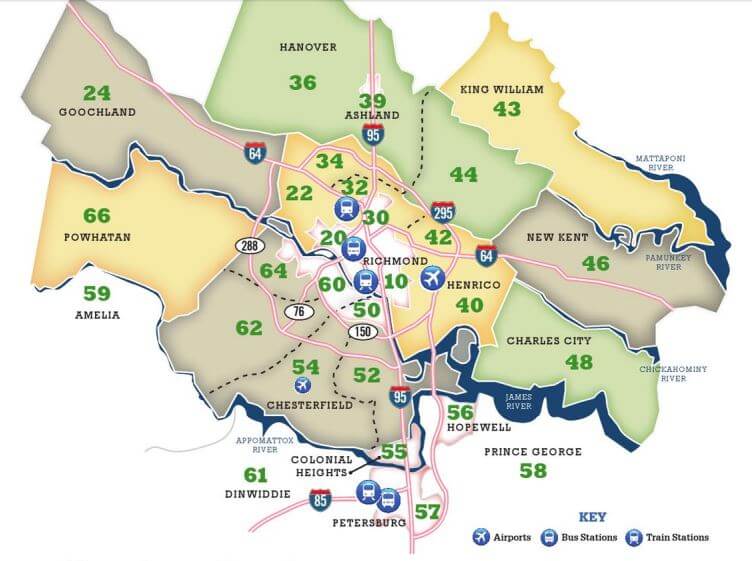

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

How Covid 19 Could Be Reshaping Growth Patterns In Nova And The Rest Of Virginia Greater Greater Washington

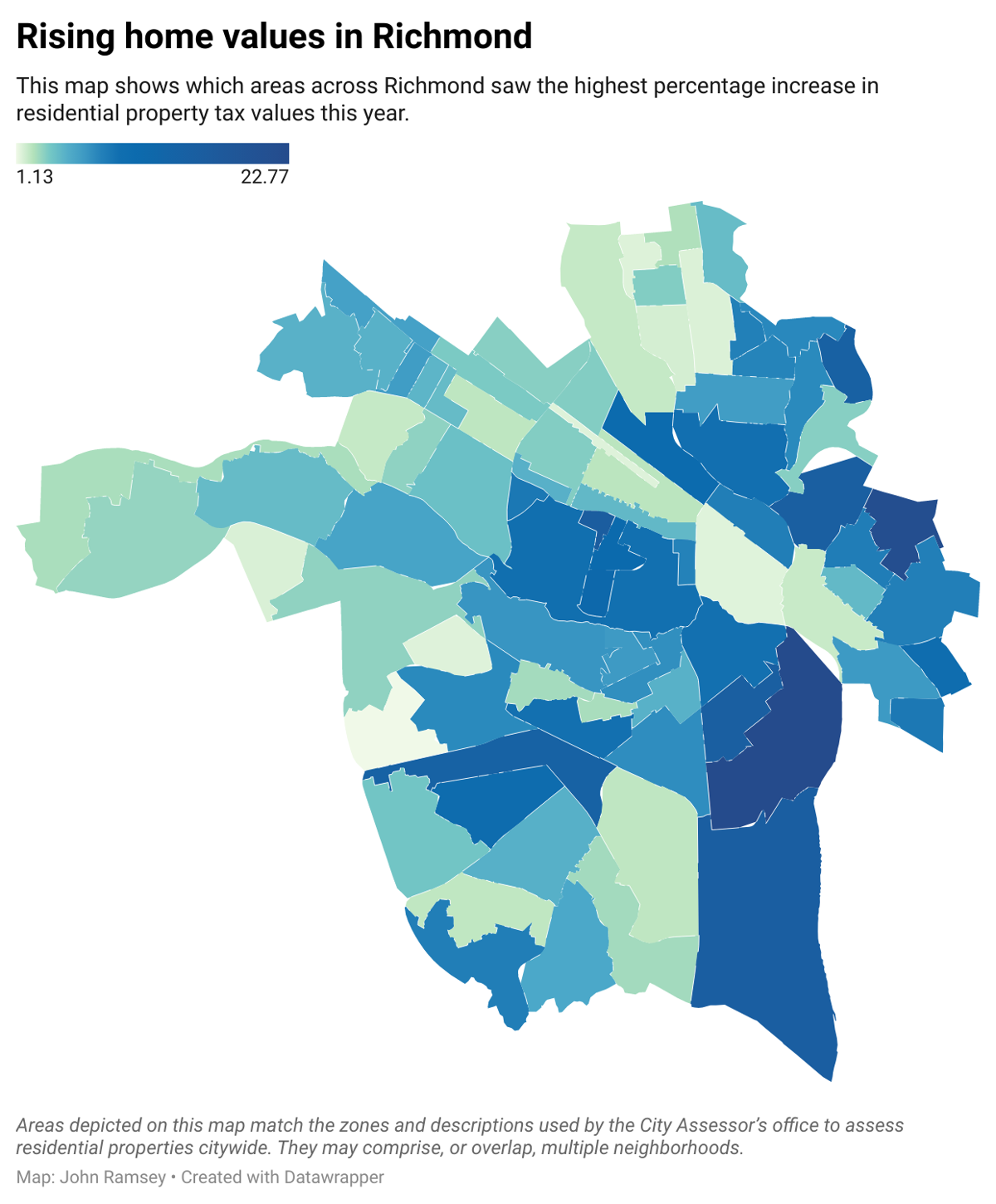

Virginia Housing Markets That Have Seen The Biggest Jumps In Home Prices Of 2021

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Property Taxes How Much Are They In Different States Across The Us

Richmond Property Tax How Does It Compare To Other Major Cities

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

503 Holbrook Avenue Danville Va 24541 Estate Homes Victorian Homes Gazebo On Deck